Vision Benefits

H&P offers vision care through Vision Service (VSP). VSP has you covered with low out-of-pocket costs and access to a nationwide network of doctors—it’s as simple as enrolling in VSP vision benefits.

View Plan DetailsDental Benefits

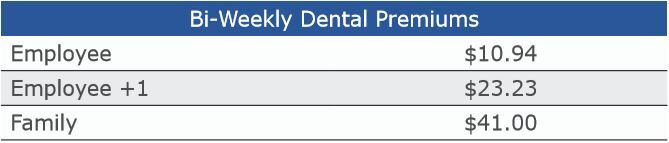

H&P offers a competitive, comprehensive dental plan through Delta Dental of Oklahoma. Delta Dental has the largest network of dentists nationwide.

DEDUCTIBLES

- $50 deductible applies to Class II and Class III services per person

- The maximum family deductible per benefit year is $150

- Deductibles do not apply to Class I or Class IV services

-

CLASS I SERVICES

Preventative Services — 100% Oral examinations, emergency palliative treatment, x-rays, fluoride and sealants for minors

-

CLASS II SERVICES

80% Fillings, crowns for dependent children, oral surgical procedures, tooth extractions, root canals and periodontics services

-

CLASS III SERVICES

50% Major restorative services for treatments of decay/cavity that cannot be restored with another filling material, partials, dentures, implants, maintenance, and repair of implants

-

CLASS IV SERVICES

50% Orthodontic services for dependents children under the age of 26; orthodontic lifetime limit is $1,500

MDLive: Talk to a Doctor Anytime, Anywhere by Phone or Video

Set up your account today to talk to a U.S.-licensed physician for non-emergency medical conditions like the flu, sinus infections, bronchitis, and much more.

1) Create an account. Use your phone, the app or the website to create an account and complete your medical history.

2) Talk to a doctor. Request a time and an MDLive doctor will contact you.

3) Feel better. The doctor will diagnose symptoms and send you a prescription if necessary.

Call 888-970-4081

The Employee Assistance Program (EAP) offered through Magellan provides free services for you and your household members.

KEY FEATURES:

- Provided at no cost to you and your household members

- Includes up to 5 counseling sessions

- Completely confidential service provided by a third party

24/7 Support | 800-424-4105

Member.MagellanHealthcare.com | Watch the EAP Video

-

BetterHelp Virtual Therapy

Through this program, you have access to confidential virtual therapy at no cost to you. Counseling is available for the entire family—individuals, couples and teens (with parental consent and in accordance with applicable law and clinical appropriateness). This is available by text message, live chat, phone or video conference. Register online or call 800.424.4105 (TTY 711).

-

Work-Life Services

Save time and money on life’s most important needs. Specialists provide expert guidance and personalized referrals to service providers including childcare, adult care, education, home improvement and more. The website includes webinars, live talks and articles focused on key life events and day‑to‑day challenges.

-

Lifestyle Coaching

Define and reach your goals with the support of a coach. Coaches can help with personal improvement, healthy eating, weight loss and more. Coaches are available by phone or video.

-

FINANCIAL WELLNESS, LEGAL SERVICES, AND IDENTITY THEFT RESOLUTION

Meet with experts that can help you take control of your finances, resolve legal issues such as estate planning and family law, restore credit, research specific topics and/or print your own state-specific legal forms.

-

DIGITAL EMOTIONAL WELLNESS TOOLS

Take advantage of proven programs to help manage anxiety, stress, depression, pain, sleep, substance misuse or recovery and more. Personalized and interactive with self-directed activities, uplifting stories, videos and daily inspiration help you live your best life.

Retirement Plans

H&P cares about your future and providing ways you can save for retirement. H&P contributes dollar for dollar up to 5% each year to help you achieve your retirement goals.

Contact Vanguard to:

- Rollover an old 401(k)

- Add or change your beneficiary

- Change your 401(k) contribution amount

800-532-1188

Vanguard.com

-

Enrollment

New employees are auto-enrolled at 3%.

Default investment is the age appropriate Target Retirement Fund

-

Contribution Options

Employees are able to enroll in and of the following retirement plans:

- Pre-tax/Traditional

- Post-tax/Roth

- Combination of Traditional and Roth -

H&P Vesting Schedule

After Year 1 - 0%

After Year 2 - 50%

After Year 3 - 100%

Life, AD&D and Disability Insurance

You may obtain additional coverage for yourself and your eligible dependents through MetLife. Options include supplemental life and AD&D and long-term disability.

ELIGIBILITY

All active, benefit eligible employees are auto enrolled into basic life and AD&D insurance policy covered by H&P. Employees will become eligible for basic life and AD&D insurance on the first day they are eligible for benefit coverage.

Basic Benefit: Employees are guaranteed 2× their Annual Compensation rounded to the next higher $1,000.

Maximum Benefit: The lesser of 2× Annual Compensation or $300,000.

Beneficiary Assignment: It’s important to make sure H&P has your most up-to-date beneficiary on file. In the tragic event of one’s passing, H&P is legally required to pay the beneficiary on record.

Purchase optional life and AD&D insurance for yourself, your spouse and/or your dependent children

Employee: Voluntary life and AD&D insurance is also available for. You are able to elect 5× annual salary up to $1,000,000. As a new hire or newly eligible employee, you can elect 3× annual salary up to $500,000 without evidence of insurability (EOI).

Child: Employees can cover their dependent child(ren) on life and AD&D insurance up to the age of 19 years old under the following option. All dependent child(ren) benefits are Guaranteed Issue in the amount of $10,000.

Spouse: If you elect voluntary life and AD&D coverage for yourself, you can also elect voluntary life and AD&D coverage for your spouse. MetLife allows several incremental options based on your annual compensation outlined in the table below. The maximum of the supplemental spouse life benefit is 50% of your basic and supplemental life amount up to $275,000.

Option 1: 0.5x the Employee's annual compensation

Option 2: 1.0x the Employee's annual compensation

Option 3: 1.5x the Employee's annual compensation

Option 4: 2.0x the Employee's annual compensation